Services

Latest Posts

Toronto's housing affordability trends from 1976 to 2024 reflect a sharp and persistent decline in affordability, as seen in the dramatic rise in the price-to-income ratio. Here's a detailed analysis: Long-Term Trend in Housing Affordability The price-to-income ratio (inflation-adjusted) rose from 4.4 in 1976 to 16.0 in 2023, reflecting a 512% increase in real home[...]

1/ Lower rates = bigger market. More folks can afford loans when monthly payments drop. Simple math: same house, lower payment = more potential borrowers. 2/ Quality boost: When rates fall, existing borrowers breathe easier. Their debt payments shrink relative to income. Default risk ⬇️ 3/ The fixed-income goldmine: Banks holding long-duration bonds saw[...]

Key Observations Real Boom (Green Box): This period refers to historically robust population growth driven by organic economic factors. These could include: Natural Population Growth: High birth rates or family sizes. Economic Prosperity: Agricultural or industrial expansions providing stable economic opportunities. Immigration Waves: Large-scale immigration, particularly during Canada's nation-building era in the late 19th[...]

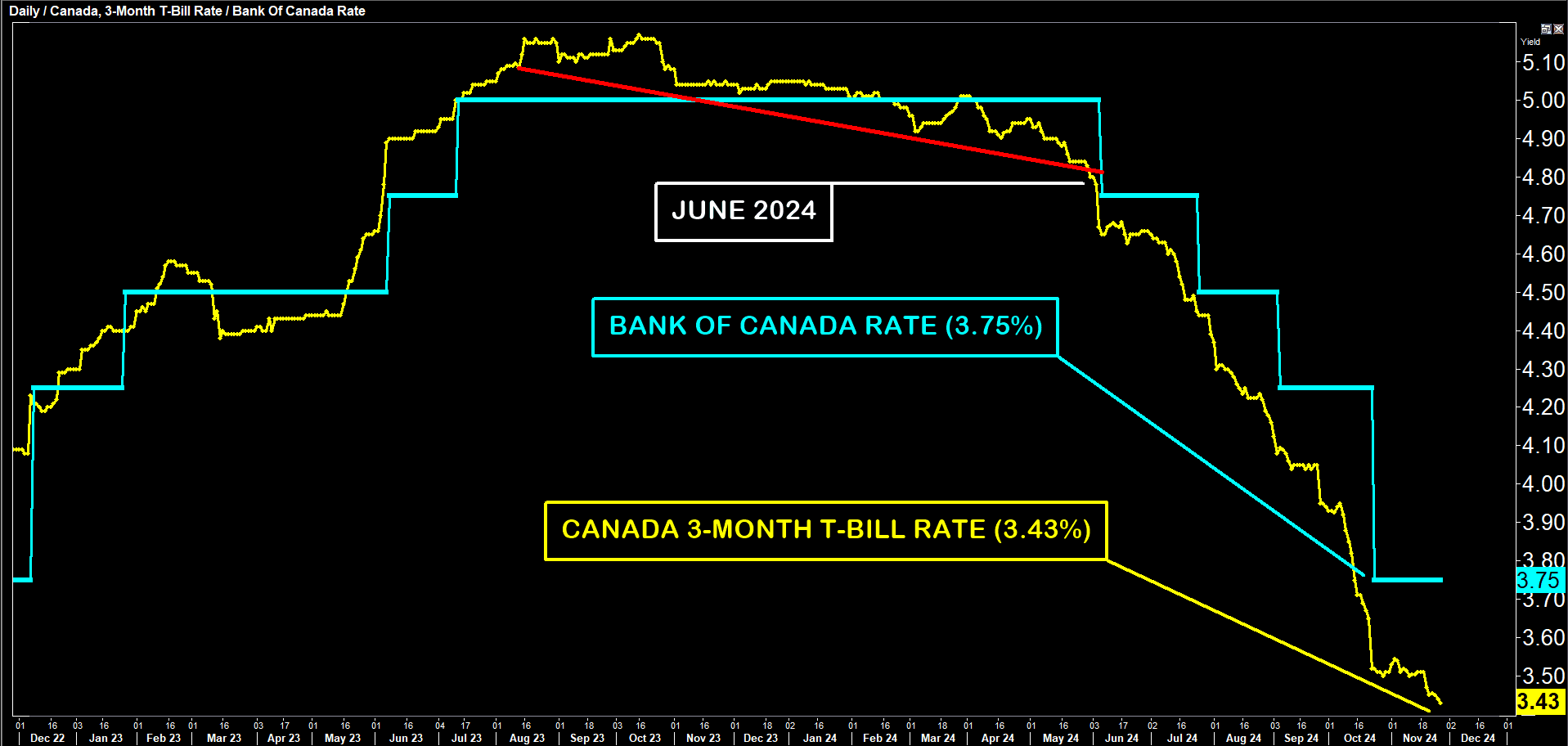

The financial markets are sending clear signals about Canada's economic trajectory. The significant gap between the Bank of Canada's policy rate (3.75%) and the 3-month T-Bill rate (3.43%) isn't just a technical detail - it's revealing a compelling narrative about our economic future. Markets are pricing in cuts between 0.25% to 0.50%, but this anticipated[...]

Devil Take the Hindmost by Edward Chancellor was the first book I picked up about speculation and market euphoria, and it left a lasting impression. The book masterfully outlines the dangers of following the crowd, the perils of unchecked credit bubbles, the risks of leverage, and the folly of overpaying for assets. Chancellor’s deep dive into[...]

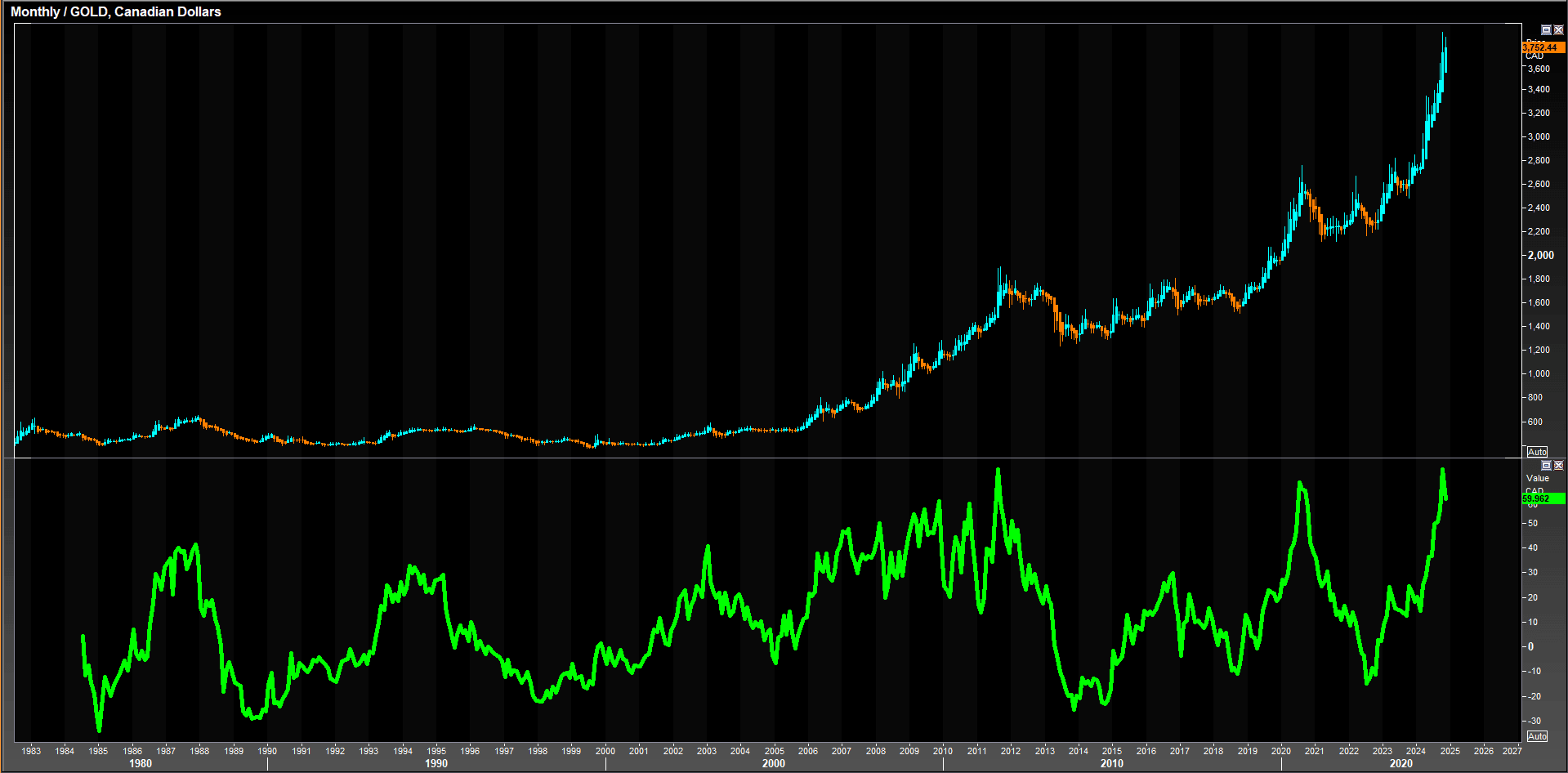

Gold In Canadian Dollars with a 24-month ROC! LOG FORMAT (Gold in CAD): The price of gold in Canadian Dollars has shown a long-term uptrend, with recent acceleration to all-time highs. Key inflection points, such as the spikes around 1980, 2011, and the present, indicate strong bullish momentum during these periods. The steep rise reflects[...]