- All

- 2024

- Asset Mania's

- BITCOIN

- Climate Change Bubble

- Creative Destruction

- Decentralization

- Economic Winter Watch

- Economics

- Economy

- GOLD

- Interest Rates

- Japan

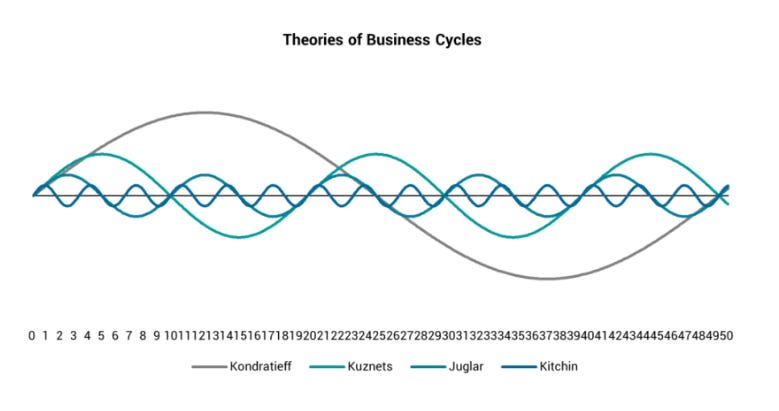

- Kondratieff's Monetary Wave

- Market's

- Ponzi Finance

- Population Growth

- Questions

- Real Estate

- Recession Watch

- Schumpeter

- TELTAAM

- The Economic LongWave Podcast

- The Kondratieff Cycle

- The LongWave Model

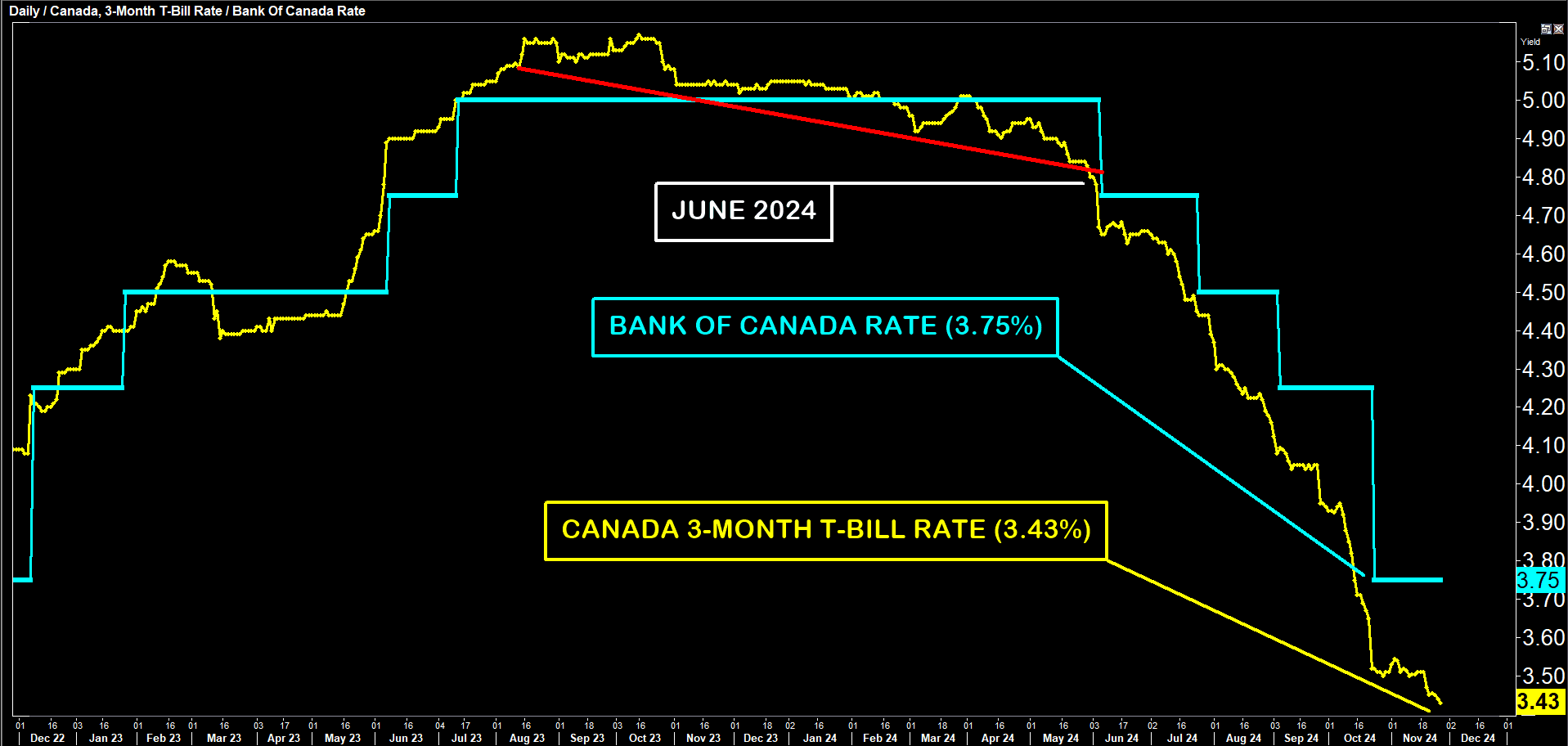

The financial markets are sending clear signals about Canada's economic trajectory. The significant gap between the Bank of Canada's policy rate (3.75%) and the 3-month T-Bill rate (3.43%) isn't just a technical detail - it's revealing a compelling narrative about our economic future. Markets are pricing in cuts between 0.25% to 0.50%, but this anticipated[...]

Devil Take the Hindmost by Edward Chancellor was the first book I picked up about speculation and market euphoria, and it left a lasting impression. The book masterfully outlines the dangers of following the crowd, the perils of unchecked credit bubbles, the risks of leverage, and the folly of overpaying for assets. Chancellor’s deep dive into[...]

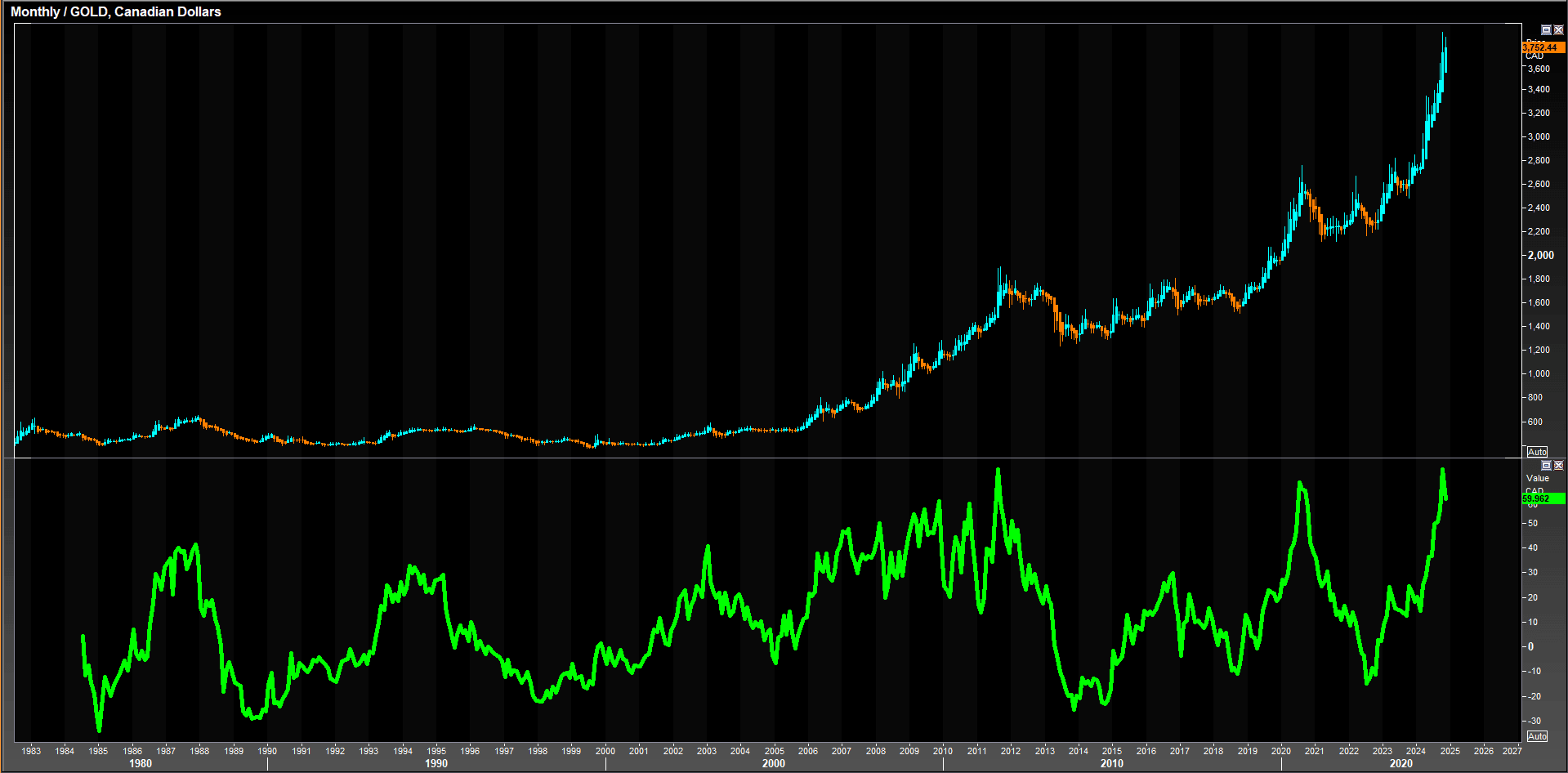

Gold In Canadian Dollars with a 24-month ROC! LOG FORMAT (Gold in CAD): The price of gold in Canadian Dollars has shown a long-term uptrend, with recent acceleration to all-time highs. Key inflection points, such as the spikes around 1980, 2011, and the present, indicate strong bullish momentum during these periods. The steep rise reflects[...]

For decades, mortgage credit has been a cornerstone of Canada’s housing market and broader economy. Today, we find ourselves at an inflection point: credit levels have soared to unprecedented heights, yet growth is slowing. What does this mean for Canada’s future housing market and economic stability? Let’s dive into the data and explore the trends[...]

True innovation drives economic growth through several key mechanisms: 1. Productivity Improvements - New technologies and methods allow more output from the same inputs - Examples: Assembly lines, computers, automation systems 2. New Market Creation - Entirely new products/services create additional economic activity - Examples: Smartphones created the app economy, EVs spawning charging networks 3.[...]

Abstract The paper analyzes N. D. Kondratieff's approach to the construction of a general theory of dynamics, presented in his unfinished work ‘Basic Problems of Economic Statics and Dynamics’, written in prison. The approach proposed by Kondratieff is considered in the context of the discussion of this problem in the West, including in connection with[...]

Based on an analysis of primary historical asset bubbles, the average price collapse has been approximately 80%. However, the severity varies significantly depending on the type of asset and market conditions: Most Severe: The Dutch Tulip Mania (1637) saw a nearly complete collapse of 99%, making it the most dramatic bubble burst in recorded history.[...]

Economic growth follows an S-curve, tapering off throughout a LongWave. A fundamental economic reality is often misunderstood: While economies do expand at rates beyond simple arithmetic progression, they don't achieve true geometric growth. Instead, they follow an S-curve pattern - rapid initial growth that gradually decreases as the business cycle matures. The critical issue[...]

Joseph Schumpeter (1883-1950) was an influential Austrian-American economist and political scientist. He is best known for his theories on capitalist development and entrepreneurship. Some key points about Joseph Schumpeter: - He popularized the concept of "creative destruction" - the cyclical process of industrial mutation that incessantly revolutionizes the economic structure from within, incessantly destroying the[...]

This is where the Economic LongWave, or Kondratieff cycle, and Martin Armstrong's model differ in the following critical ways: 1. Cycle Basis - Kondratieff Cycle (Economic LongWave): This model runs on long-term economic cycles stimulated by technological innovation, capital investment, and debt accumulation. It posits that economies go through foreseeable phases—Spring, which is expansion; Summer,[...]

As we approach the end of 2024, many economic tailwinds that have supported growth over the past few years are beginning to dissipate. This raises a crucial question: What will the economy look like in 2025 once these supportive factors have fully wound down? Understanding the Tailwinds of Recent Years In the aftermath of the[...]

Low interest rates have been a defining feature of the Monetary Wave, shaping the economic landscape over the past few decades. While these rates have been celebrated for spurring economic activity and fostering growth, they have also introduced significant risks that are often overlooked. The long-term impact of sustained low interest rates has profound implications[...]

This development aligns with Schumpeter's idea of "creative destruction," where innovative breakthroughs disrupt and eventually replace existing technologies. In this case, Samsung's solid-state batteries could render current lithium-ion technology obsolete, driving significant progress in the EV market. Additionally, this innovation is expected to be a key component of Kondratieff's fifth wave—a long-term economic cycle characterized[...]

The Common Denominator of Asset Bubbles Throughout History Asset bubbles share several common denominators, regardless of the era or the specific assets involved. Understanding these elements helps identify and avoid future bubbles. Here are the key factors: 1. Excessive Speculation: - Speculation drives asset prices far beyond their intrinsic value. Investors buy not based[...]

Based on the present combination of extreme valuations, unfavorable and deteriorating market internals, and a rare preponderance of warning syndromes in weekly and now daily data, my impression is that the speculative market advance since 2009 ended last week. Barring a wholesale shift in the quality of market internals, which are quickly going the wrong[...]