This is where the Economic LongWave, or Kondratieff cycle, and Martin Armstrong’s model differ in the following critical ways:

1. Cycle Basis

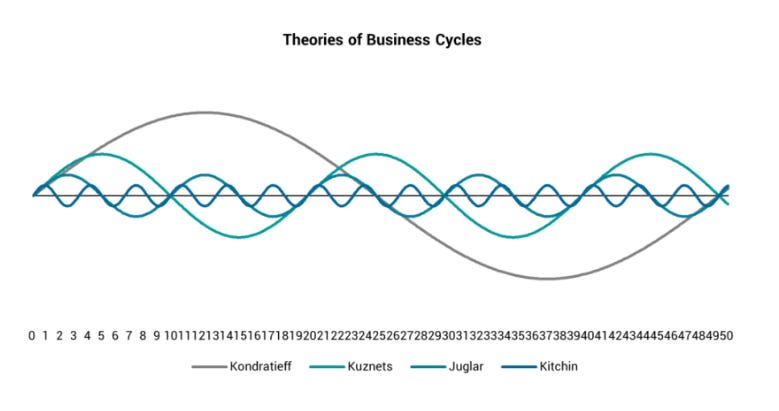

– Kondratieff Cycle (Economic LongWave): This model runs on long-term economic cycles stimulated by technological innovation, capital investment, and debt accumulation. It posits that economies go through foreseeable phases—Spring, which is expansion; Summer, which is stagflation; Fall, which includes deflation; and finally, Winter, which includes depression. The Kondratieff cycle takes an interest in how these four stages are influenced by changes in technological advancements and changes in economic structures with the buildup and unwinding of debt.

– Martin Armstrong’s Model: This model is based on his Economic Confidence Model. It bases its roots on data analysis and cyclical patterns of history. He relies strictly on the cyclical capital flows, geopolitical events, and economic cycles. Armstrong’s model takes business cycle on 8.6 years, which he refers to as the dimension from Pi (π), reflecting the natural ebb and flow of economic and political trends globally. His model focuses more on the influence that human behaviors, political decisions, and capital movement have on economic outcomes.

2. Drivers of Cycles

– Kondratieff Cycle: In accordance with those alternating structural changes in the economy, technological innovations, demographic transitions, and long-term debt cycles. A Kondratieff cycle thus looks for technological waves that lead upswings and downswings in the economy, taking the buildup and liquidation of debt as a big explanation for economic downturns.

– Armstrong’s Model: Focuses on cycles powered by shifts in the flows of capital, confidence, and government policy. Armstrong states that markets are nothing more than a mirror of human emotion and political actions that result in periodic cycles. His model takes on board a broader meaning of economic cycles that bring in all sorts of historical events, natural cycles, and mathematical patterns.

3. Economic Phases Approach

– Kondratieff Cycle: Views the economic phases (Spring, Summer, Fall, Winter) as extended periods lasting 40 to 60 years each, with clear demarcations between phases based on technological innovation and debt cycles. Each phase has certain characteristics to it: growth, inflation, deflation, and recession.

– Armstrong’s Model: Uses much shorter cycles (8.6 years) and the sub-cycles within these periods, which reflect changes in economic confidence, political stability, and capital flows. Armstrong’s model looks at turning points in the economy, often driven by shifts in confidence and capital flows between public and private sectors.

4. Key Differences in Predictions

– Kondratieff Cycle: A theory that states economic cycles are predictable according to history time series of technological innovation and accumulation of debt. It forecasts long stretches in which the economy will perform below its potential (economic winter) due to excess debt and structural imbalances.

– Armstrong’s Model: Gives more specific and more frequent turning points, predicting the economic cycles on the basis of capital flows and government policy changes. Armstrong is known for his emphasis on geopolitical risks and the influence of political decision-making on economic cycles, often noting how intervention by governments makes trends worse.

5. Philosophical Differences

– Kondratieff Cycle: It is more deterministic in the nature of economic cycles and suggests that technological and debt cycles are drivers for nearly inevitable economic results. It sees the cycles as almost entirely determined by structural economic factors that are difficult to alter without massive technological or societal changes.

– Armstrong’s Model: In the establishment of economic results, Armstrong’s model bears an essence of paramountcy regarding human behavior, confidence, and government intervention. Compared to other models, this model is much less deterministic and relies on the interaction of a multiplicity of factors that incorporate some dimensions of politics and the social sphere in their impact on economic cycles.

Conclusion

Although both the Economic LongWave (Kondratieff cycle) and Martin Armstrong’s model seek cyclical patterns in the economy, they differ in respect to emphasis, drivers, approach toward economic phases, and philosophy of basis. Kondratieff is one who looks at long-term structural economic changes, while Armstrong’s model focuses more on the dynamic interaction of capital flows, confidence, and government actions over the shorter cycles