Canada’s Household Debt: The End of the Credit Era?

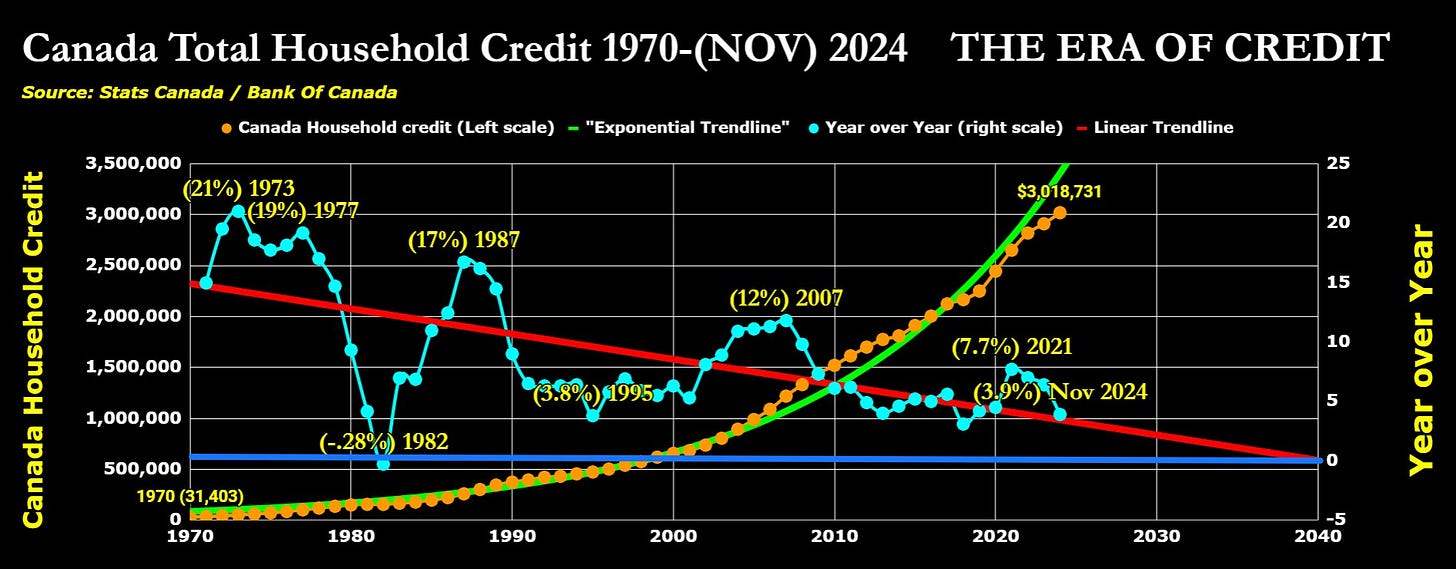

The story of Canadian household debt over the past five decades reads like a cautionary tale. Recent data from Statistics Canada and the Bank of Canada paints a stark picture: Canadian households have embarked on a borrowing spree that has taken total household credit from a modest $3,100,403 in 1970 to an astounding $3 Billion by late 2024.

The Growth Story

This isn’t just normal growth – it’s exponential. While previous decades saw growth rates soaring as high as 21% (1973), 19% (1977), and 17% (1987), recent years have shown a marked slowdown. As of November 2024, the year-over-year growth rate is just 3.9%, suggesting we might be approaching a pivotal moment in Canada’s credit story.

Warning Signs

The data reveals several concerning trends:

1. The sheer magnitude of debt accumulation has far outpaced economic growth

2. Growth rates, while still positive, have declined significantly

3. The exponential trend appears unsustainable in the long term

What’s Next?

The million-dollar question (or, in this case, the three-million-dollar question) is: when will Canadians start to deleverage? While the current data doesn’t show actual deleveraging yet, the declining growth rates suggest we’re approaching a crossroads. Several factors could trigger this shift:

– Sustained high interest rates, making debt servicing increasingly difficult

– A potential housing market correction

– The growing burden of debt servicing costs relative to household income

The Bottom Line

Canada’s “Era of Credit” has lasted for over fifty years, but the signs of strain are showing. While the party isn’t over yet, the music is getting quieter. As we look ahead, the key question isn’t if Canadian households will deleverage, but when – and whether it will be by choice or necessity.

The declining linear trend in credit growth rates suggests a natural slowdown is underway. However, transitioning from slower credit growth to actual debt reduction could be one of Canadian households’ most significant economic challenges in the coming years.