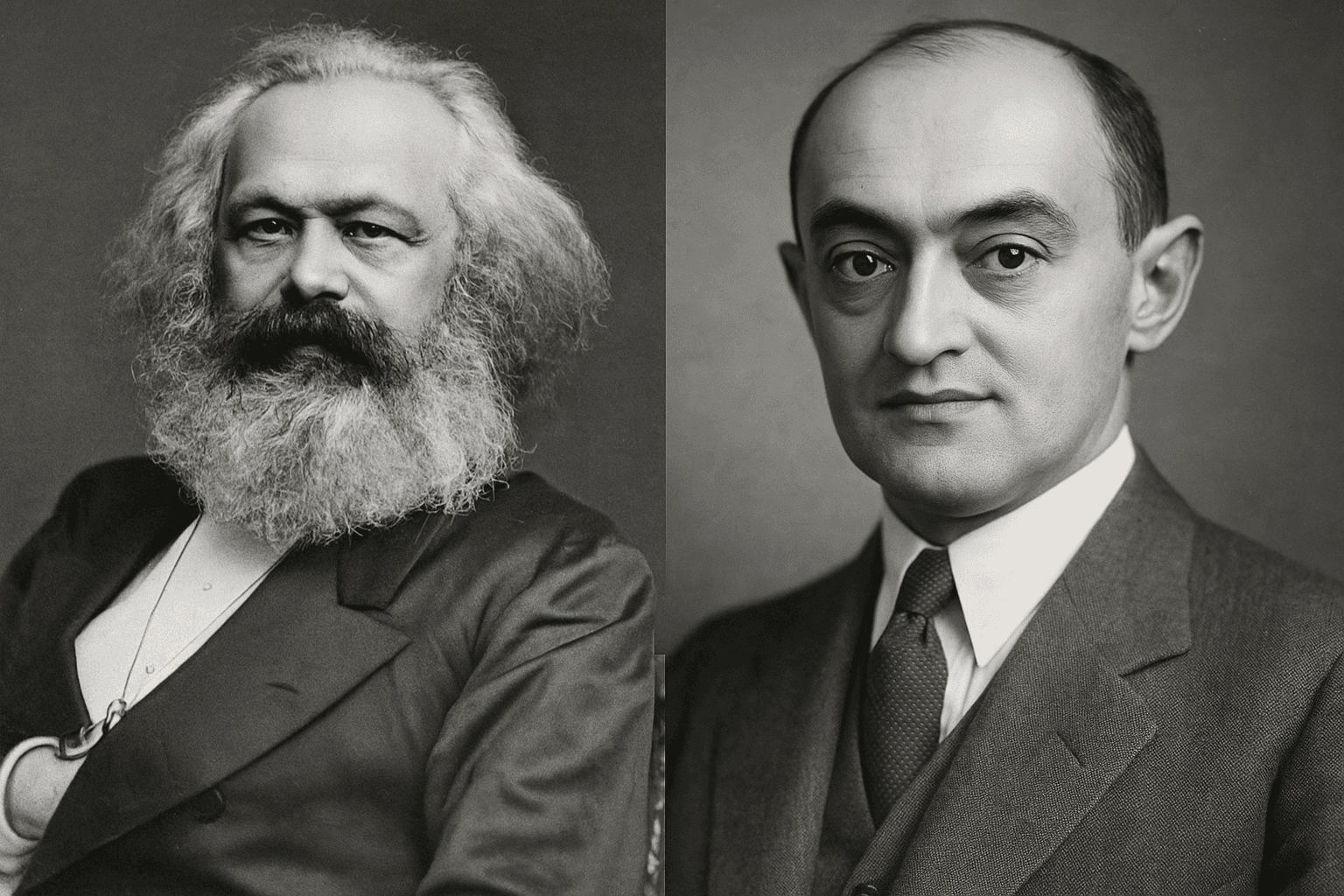

Marx & Schumpeter’s Warning: Why Finance Has Become “Parasitical” to the Real Economy

Understanding the Long Wave Cycles and Creative Destruction in Today’s Economic Winter

The Prophetic Critique That Still Defines Our Times 🎯

In an era where financial markets reach record highs while manufacturing productivity stagnates, two of history’s most influential economists offer a prescient warning. Both Karl Marx and Joseph Schumpeter, despite their vastly different ideologies, identified a fundamental problem: finance becomes “parasitical” when it extracts wealth without creating genuine economic value.

As we stand at the precipice of what Kondratieff Wave theory suggests is an approaching economic winter, their 150-year-old insights have never been more relevant to understanding our current financial landscape.

The Kondratieff Context: Where We Stand Today 📊

To understand the Marx-Schumpeter critique, we must first position ourselves within the framework of the Long Wave. We are currently in the centralized fourth wave of the Kondratieff cycle, characterized by the advancement of information technology and automation. This wave encompasses multiple embedded cycles:

The Nested Cycle Structure:

- Kitchin Cycles (3-5 years): Technology inventory adjustments and short-term market corrections

- Juglar Cycles (7-11 years): Fixed investment cycles in major technological infrastructure

- Kuznets Swings (15-25 years): Infrastructural investment cycles, including today’s digital real estate and platform monopolies

- Kondratieff Wave (75-100 years): The complete technological transformation cycle

We are transitioning from the autumn phase (speculative peak) into the winter phase (debt deflation and economic reset). This transition makes the distinction between productive and parasitic finance critical.

Marx’s Foundational Insight: The Fiction of Financial Capital 🔴

Karl Marx distinguished sharply between productive capital—invested in machinery, labour, and actual production—and financial capital—money seeking profit purely through interest, speculation, and financial engineering. His core argument was that financial speculation creates no real value; it merely redistributes existing wealth while extracting profits through fees and interest.

This creates what Marx termed “fictitious capital”—financial assets whose values become increasingly disconnected from the underlying productive assets they are supposed to represent. We see this phenomenon clearly in today’s markets, where derivative instruments often dwarf the value of the tangible assets they’re based upon.

Modern Examples of Marx’s “Fictitious Capital”:

- Derivatives markets exceed $600 trillion, while global GDP remains around $100 trillion

- Stock valuations based on financial engineering rather than productive capacity

- Real estate investment vehicles that extract wealth from housing without building homes

- Complex financial instruments that obscure rather than clarify economic risk

Schumpeter’s Creative Destruction and Financial Intermediation 🚀

Joseph Schumpeter approached the problem from a different angle but reached remarkably similar conclusions. His theory of creative destruction—where innovations replace obsolete industries—recognized that legitimate financial intermediation was essential for economic development. Finance, at its best, connects savers with innovative entrepreneurs who drive genuine economic progress.

However, Schumpeter was deeply concerned about speculative finance that diverted resources away from genuine innovation. In his framework, parasitical finance inhibits creative destruction by:

Blocking Innovation Through:

- Misallocating capital away from breakthrough technologies toward speculative bubbles

- Creating asset price distortions that reward financial engineering over productive investment

- Generating profits for intermediaries without contributing to technological advancement

- Encouraging short-term thinking that undermines long-term research and development

Current Technology and Creative Destruction:

Today’s financial technology sector perfectly illustrates Schumpeter’s principles in action:

Destructive Elements:

- Fintech solutions are displacing the traditional banking infrastructure

- Cryptocurrency is challenging central banking monopolies

- Algorithmic trading is replacing human financial intermediaries

- Blockchain technology is eliminating traditional clearing and settlement systems

Creative Elements:

- Democratized access to investment tools and market information

- Reduced transaction costs for global commerce

- Enhanced financial inclusion for underbanked populations

- New forms of value creation through decentralized finance protocols

The question becomes: Which elements represent genuine creative destruction versus mere wealth extraction dressed as innovation?

Socioeconomic Forces: The Human Psychology Behind Financial Cycles 🌊

The interaction between social forces and financial markets creates predictable cyclical patterns that both Marx and Schumpeter recognized, though they emphasized different aspects.

The Innovation-to-Speculation Cycle:

- Genuine Innovation Phase: New technologies emerge with legitimate productive potential

- Social Adoption Phase: Early adopters generate real wealth through productive application

- Mass Psychology Phase: Social proof drives widespread adoption and investment interest

- Credit Expansion Phase: Easy money amplifies both productive and speculative investments

- Bubble Formation Phase: Financial innovation outpaces regulatory understanding and risk assessment

- Speculative Mania Phase: Social mood shifts to “irrational exuberance” and FOMO behaviour

- Reality Check Phase: Underlying productive capacity fails to justify inflated valuations

- Debt Deflation Phase: Overleveraging forces economic restructuring and wealth destruction

This cycle repeats across different technological waves: railroads in the 1800s, automobiles and radio in the 1920s, internet companies in the 2000s, and cryptocurrency/tech stocks in the 2020s.

Social Psychology and Long Wave Theory:

The human psychological element cannot be understated. Social mood swings drive both the euphoric phases that create bubbles and the pessimistic phases that cause crashes. Financial institutions, rather than serving as stabilizing forces, often exacerbate these psychological extremes by expanding credit during optimistic phases and contracting it during pessimistic ones.

The Modern Verdict: Distinguishing Productive from Parasitical Finance ⚖️

The Marx-Schumpeter critique contains profound truth, but requires sophisticated application to today’s complex financial landscape.

Valid Contemporary Concerns:

High-Frequency Trading and Market Microstructure:

- Algorithms extracting profits from millisecond price differences without adding economic value

- Market fragmentation that increases complexity while reducing transparency

- “Front-running” technologies that profit from information advantages rather than productive investment

Financial Engineering Over Real Investment:

- Corporate resources are devoted to stock buybacks rather than research and development

- Complex derivatives that obscure risk rather than genuinely manage it

- Private equity strategies focused on financial restructuring rather than operational improvement

Credit Inflation and Asset Bubbles:

- Easy monetary policy enabling speculation in non-productive assets

- Housing and equity markets are disconnected from underlying economic fundamentals

- Credit expansion that rewards leverage rather than productive capacity

Important Nuances and Legitimate Functions:

However, modern finance also performs genuinely valuable functions that Marx and Schumpeter would likely recognize as productive:

Risk Management and Capital Allocation:

- Insurance markets that enable economic activity by spreading risk

- Venture capital that funds breakthrough technologies and business models

- International trade finance that facilitates global commerce

- Pension and retirement systems that will allow long-term planning

Financial Inclusion and Democratization:

- Mobile payment systems are expanding economic participation in developing countries

- Robo-advisors are making professional investment management accessible to middle-class investors

- Crowdfunding platforms connecting entrepreneurs with distributed capital sources

- Cryptocurrency enables financial services in regions with inadequate banking infrastructure

LINK TO SUBSTACK Preparing for Economic Winter: Strategic Implications ❄️

The Enduring Relevance of Classical Economic Wisdom 💡

The Marx-Schumpeter critique of parasitical finance offers timeless insights precisely because it focuses on the fundamental relationship between financial systems and real economic production. Their warnings resonate across technological cycles because human psychology and institutional dynamics remain remarkably consistent.

Key Takeaways for Modern Application:

- Finance serves the economy best when it channels resources toward genuine creative destruction rather than merely redistributing wealth.

- Social psychology drives cyclical patterns of innovation, speculation, and correction that financial institutions amplify rather than moderate.

- Economic winter phases, while painful, serve the essential function of reallocating resources from speculative to productive uses.

- The distinction between productive and parasitical finance becomes most critical during transition periods between technological waves.

As we navigate the coming economic winter, the Marx-Schumpeter framework offers both a warning and an opportunity. Those who heed their insights about distinguishing between productive and parasitical finance will be best positioned not only to survive the transition but also to participate in building the foundation for the next great wave of genuine economic prosperity.

The question for our time is not whether finance will continue to evolve—it will. The question is whether it will become in directions that serve genuine creative destruction and productive capacity, or whether it will remain trapped in parasitic patterns that Marx and Schumpeter warned would ultimately undermine the very economic systems they claim to serve.

The choice, as always, is ours to make. But history suggests that economic winters have a way of making that choice for us if we fail to make it consciously. The wisdom of these great economists provides our roadmap for navigating the transition ahead.

What patterns do you see in today’s financial markets that echo the Marx-Schumpeter warnings? Please share your thoughts on how we can better distinguish between productive and parasitic finance in our current economic environment.