The “Era of Credit” is mathematically ending – here’s what the data reveals about the 2030s transformation 📊

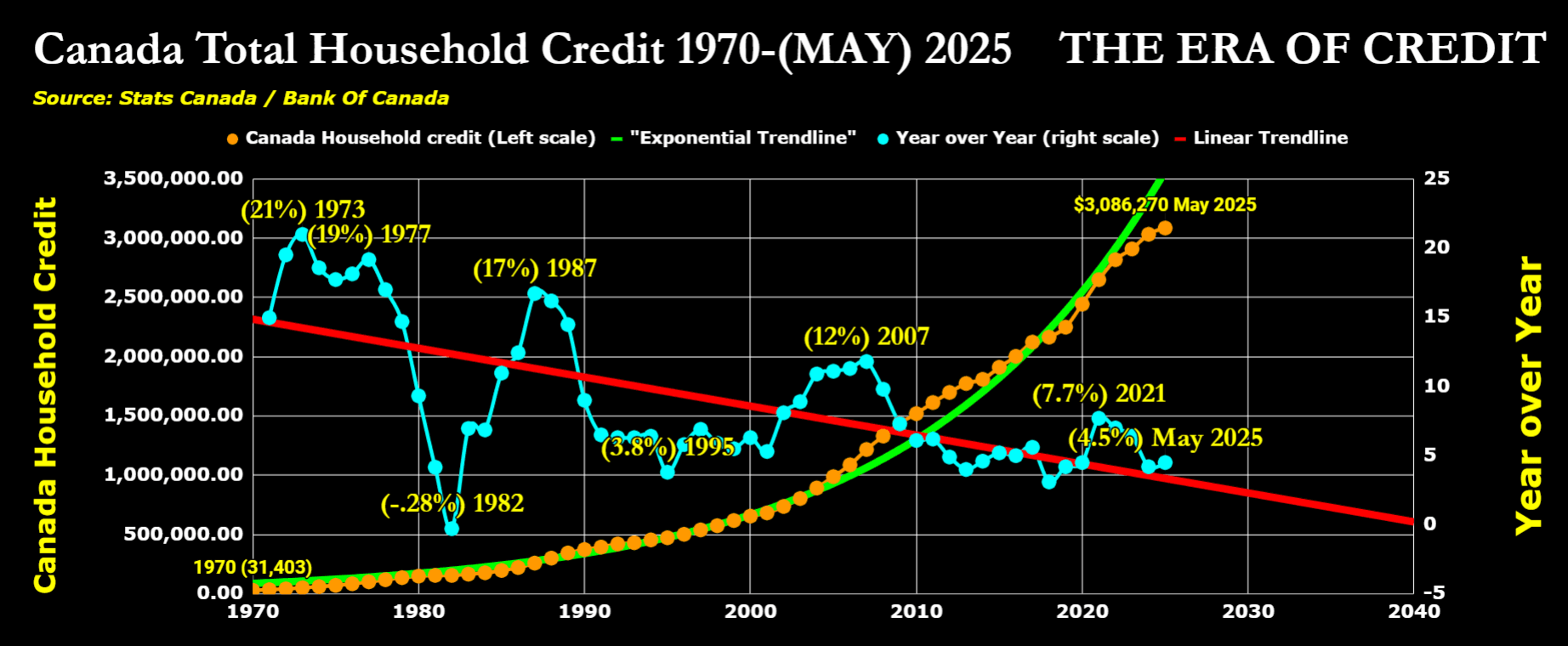

Canadian household credit: 9,600% growth from 1970-2025 ($31K → $3M+). But the Rate of Change (ROC) tells the REAL story of momentum breakdown:

📉 Peak Velocity (21%) – 1973 oil crisis 📉 Massive crash to -28% by 1982

📉 Secondary peaks declining: 19% (1977) → 17% (1987) → 12% (2007) → 7.7% (2021) 📉 Current state: 4.5% (May 2025)

The declining linear trend intersects ZERO around 2030-2035 ⚠️

This isn’t speculation – it’s mathematical trajectory based on 50+ years of consistent momentum decay. The ROC has been systematically unwinding the post-WWII credit expansion since the 1970s.

🌊 KONDRATIEFF WAVE TIMING: We’re in the final phase of the 4th technological wave (1945-2030s). Economic “winter” typically begins 75-85 years after cycle start. A deflationary transition in the 2030s fits historical patterns PERFECTLY.

This isn’t a crash – it’s a generational transformation 🔄

⚡ SCHUMPETER’S CREATIVE DESTRUCTION TIMELINE: Digital banking/fintech “destroyed” traditional lending constraints, enabling exponential debt growth. Now AI will “destroy” the credit-based economy itself, creating space for the new technological paradigm.

The 2030s timeframe gives AI/digital tech 5-10 years to mature before becoming dominant during credit contraction.

📈 THE NESTED CYCLE BREAKDOWN:

- Kitchin (3-5yr): Inventory cycles overwhelmed by credit dynamics

- Juglar (7-11yr): Business investment now credit-dependent

- Kuznets (15-25yr): Real estate cycles hitting affordability limits

- Kondratieff (75-100yr): Tech foundation shifting from industrial to digital

ALL cycles are synchronized for maximum impact 💥

🏠 SOCIOECONOMIC TRANSFORMATION: The gradual deceleration from 21% to 4.5% over 50+ years shows this is generational, not crisis. Each successive peak lower, indicating:

- Declining marginal utility of additional debt

- Demographic shifts (aging population needs less credit)

- Tech disruption of traditional credit models

- Cultural evolution away from debt-dependent lifestyles

50+ years of cultural pressure turned homes from shelter into financial instruments. Social media normalized debt-financed lifestyles. Central banks enabled it with ever-lower rates after each crisis.

📚 HISTORICAL CONTEXT: Last sustained negative credit growth was early 1980s recession. But 2030s contraction will be MORE significant because:

- Debt levels exponentially higher now

- Greater demographic burden

- More fundamental tech disruption

- Unprecedented global cycle synchronization

🎯 THE 2030s REALITY CHECK: For first time since 1982, household credit will SHRINK

- Absolute credit decline – total debt shrinking

- Forced deleveraging – widespread defaults/restructuring

- Asset deflation – real estate/financial corrections

- Economic reset – transition from credit-based to new tech paradigm

- End of debt-dependent culture

This gives society 5-10 years to prepare for the most significant economic transformation since the Industrial Revolution.

The math is inexorable. Exponential growth ALWAYS ends. The Rate of Change breakdown serves as the ultimate early warning system – and it’s been flashing red for decades.

❄️ We’re approaching Economic Winter. This makes it both more manageable AND more profound than sudden financial collapse. The question isn’t WHETHER, but HOW we navigate this generational transition.

Buckle up. The Era of Credit is ending 📈➡️📉